salt tax cap explained

Even if the SALT and mortgage-interest changes do not impact you directly do not assume your net after-tax housing costs will remain the same. If Congress does not make permanent the individual tax provisions the SALT deduction cap of 10000 per household will expire as scheduled after 2025.

Making sense of the new cap on state tax deductions.

. On state and local income taxes aka SALT. The SALT Deduction is currently capped at 10000 so if youre paying more than that in local taxes you wont. Since the SALT cap was put into place however very high earners have.

52 rows The SALT deduction allows you to deduct your payments for property. In 2018 Trump placed a cap on the SALT deduction in order to recover revenue lost from various tax cuts. 54 rows The Internal Revenue Service IRS has provided data on state and local taxes paid and deducted for tax year 2018 the first year the SALT cap went into effect.

Related

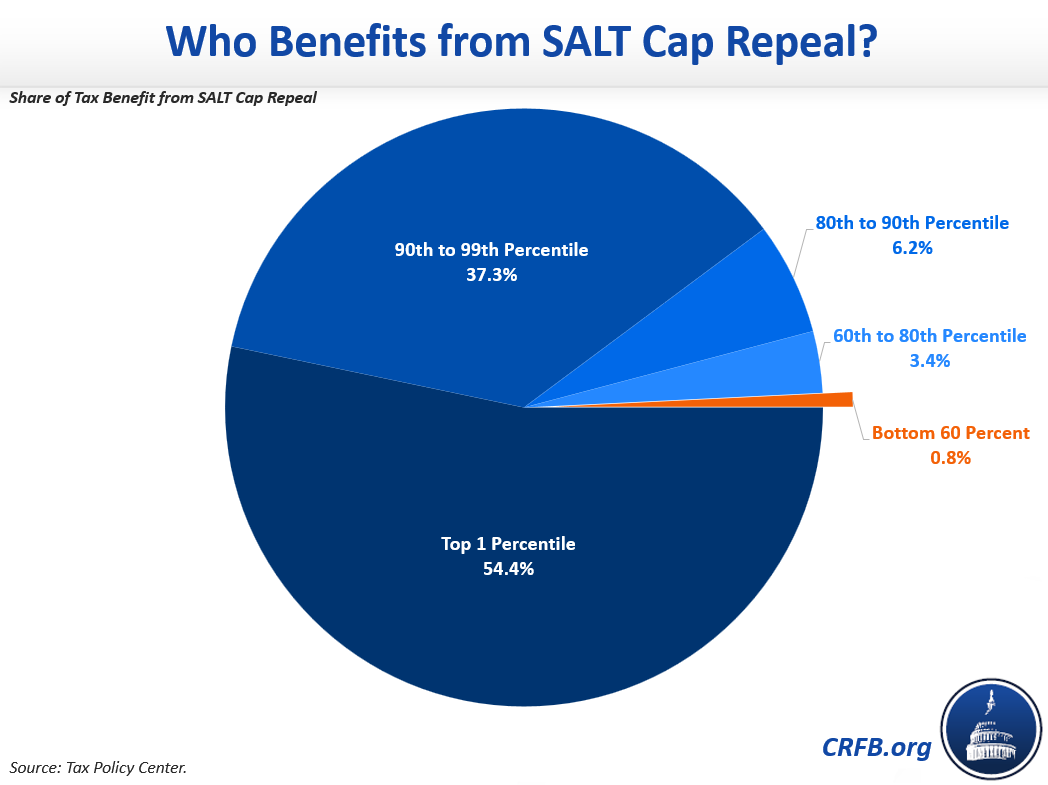

It is useful to compare the distributional impact of SALT cap repeal to other tax policies or packages. One obvious point of. Posted on November 9 2017 Updated on November 10 2017.

In 2017 during the Trump Administration the Tax Cuts and Jobs Act TCJA raised the amount of the standard deduction. Salt Tax Cap Explained - Cuomo Malliotakis And Other Officials Call On Congress To Repeal The State And Local Tax Salt Deduction Cap Silive Com - The federal tax deduction for state and local tax salt for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. The state and local tax deduction SALT for short was the most significant tax break eliminated under the tax reform framework released by.

Bringing it all together. The GOP tax bill explained. By Kathryn Vasel KathrynVasel December 20 2017.

Lifting the SALT cap much more pro-rich than Trumps tax bill. The Facts on the SALT Deduction. Income taxes sales taxes personal property taxes and certain real property taxes are eligible for the SALT deduction 1.

However many filers dont know. The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. State and Local Tax SALT tax deduction cap explained.

The electing PTE calculates its tax base and pays Minnesota state income tax but it retains certain pass-through features. Now the SALT tax cap is set to expire in 2025. The House Republican tax plan would eliminate a federal tax deduction for.

The value of the SALT deduction as a percentage of adjusted gross income AGI tends to increase with a taxpayers income. The 10000 SALT Cap Workaround Explained. To help pay for that increase SALT deductions were capped at 10 000 per.

The new law roughly. This limit on state and local tax is often abbreviated to the SALT deduction cap and was temporarily set at 10000 for single and married filers and 5000 for married couples filing separately. As of 2019 the maximum salt deduction is 10000.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. With changes to the tax code enacted in the 2017 Tax Cuts and Jobs Act deductions were capped at 10000 starting on January 1 2018. That limit applies to all the state and local.

The Joint Committee on Taxation JCT estimated that the deduction for state and local taxes paid would cost the federal government 244 billion for 2020. This limit applies to single filers joint. In the most basic terms the proposed changes to the SALT deduction would increase the deduction cap from 10000 to 72500 per year with the raised cap set to expire January 1 2032.

In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers actual 2018 state income tax liability was 6250 7000 paid minus 750 refund. The election can be made for any tax year after 2020 and is made on a timely filed Minnesota return. House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030.

Because of the limit however the taxpayers SALT deduction is only 10000. 224 PM ET. The SALT Deduction or State and Local Tax Deduction allows people to write off their local taxes from their income in federal taxes.

The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately. Homeowners who itemize deductions on their federal income tax returns have been able to deduct without limit New York State and NYC real estate taxes for decades. Starting with the 2018 tax year the maximum SALT deduction available was 10000.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

The Other Salt Cap Workaround Accountants Steer Clients Toward Private K 12 Voucher Tax Credits Itep

The Salt Cap Overview And Analysis Everycrsreport Com

State And Local Tax Salt Deduction Salt Deduction Taxedu

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Deduction Resources Committee For A Responsible Federal Budget

The State And Local Tax Deduction Explained Vox

The State And Local Tax Deduction Explained Vox

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Senators Menendez And Sanders Show The Way Forward On The Salt Cap Itep

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

How Does The Deduction For State And Local Taxes Work Tax Policy Center